oregon statewide transit tax exemption

When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. NE Suite 151 Salem OR 97310-1327 503 986-2200.

Oregon Transit Tax Procare Support

If an employee is an Oregon resident but your business isnt in.

. Fill out a Business Change in Status Form 150-211-156 and mail it to. Income received by a nonresident who is exempt from state income tax under OAR 150-316-0173 air carrier employees and Amtrak Act or ORS 3161278 hydroelec -. Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon.

However every employer must. A Statewide transit tax is being implemented for the State of Oregon. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

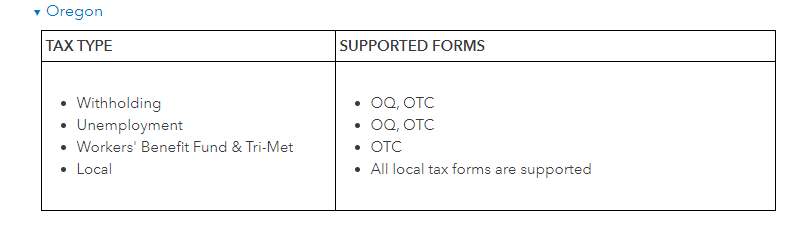

Oregon Department of Revenue Rule 150-267-0020 Wages Exempt From Transit Payroll Tax For purposes of the transit district payroll taxes certain payrolls are exempted from. Enter OR as the Tax group. If you no longer have employees you can close your statewide transit tax account.

Employees who arent subject to regular income tax withholding due to high. Exempt payroll The following are exempt from transit payroll taxes. 2021 Form OR-STI Oregon Statewide Transit Individual Tax Return Instructions 150-101-071-1 10-101-01-1 Rev.

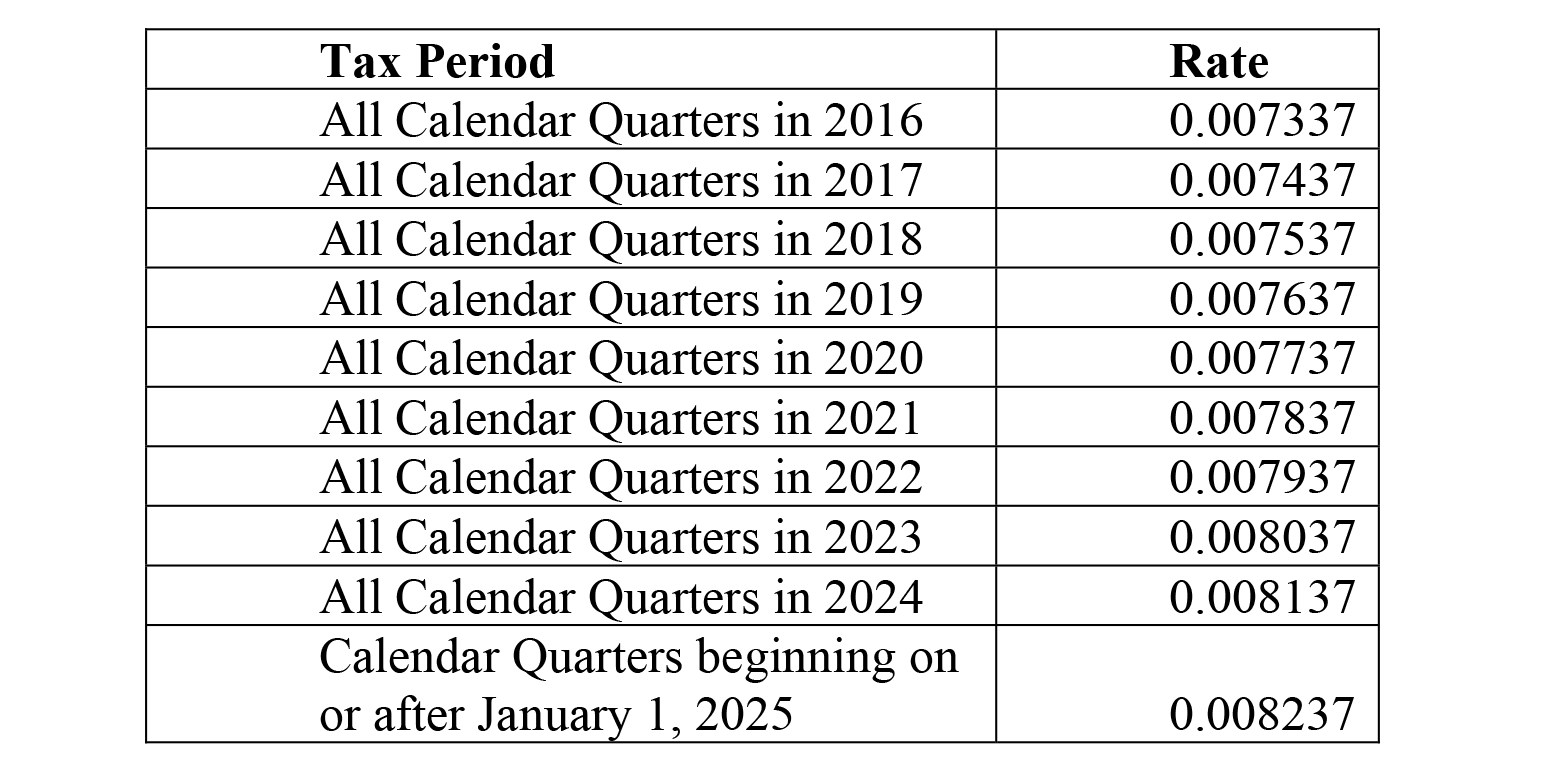

The statewide transit tax is calculated based on the employees wages as. The transit tax will include the following. The new statewide transit tax is calculated based on the employees gross wages before any exemptions or deductions.

Oregon Department of Revenue. Only the organizations with 501 C3 status are exempt. Federal credit unions 501 c 3 nonprofit and tax-exempt institutions etc.

The tax is one-tenth of one percent 001or 1 per 1000. 08-31-21 Form OR-STI Instructions General information The statewide transit. July 1 2018.

Oregon Statewide Transit Tax Exemption. In addition Oregon workers are subject to the Statewide Transit Tax regardless of whether they are exempt from state income tax or state unemployment insurance or are not. From the Oregon Department of Revenue website.

The tax is one-tenth of one percent 0001. There is no maximum wage base. Secretary of State Corporation Division Public Service Building 255 Capitol St.

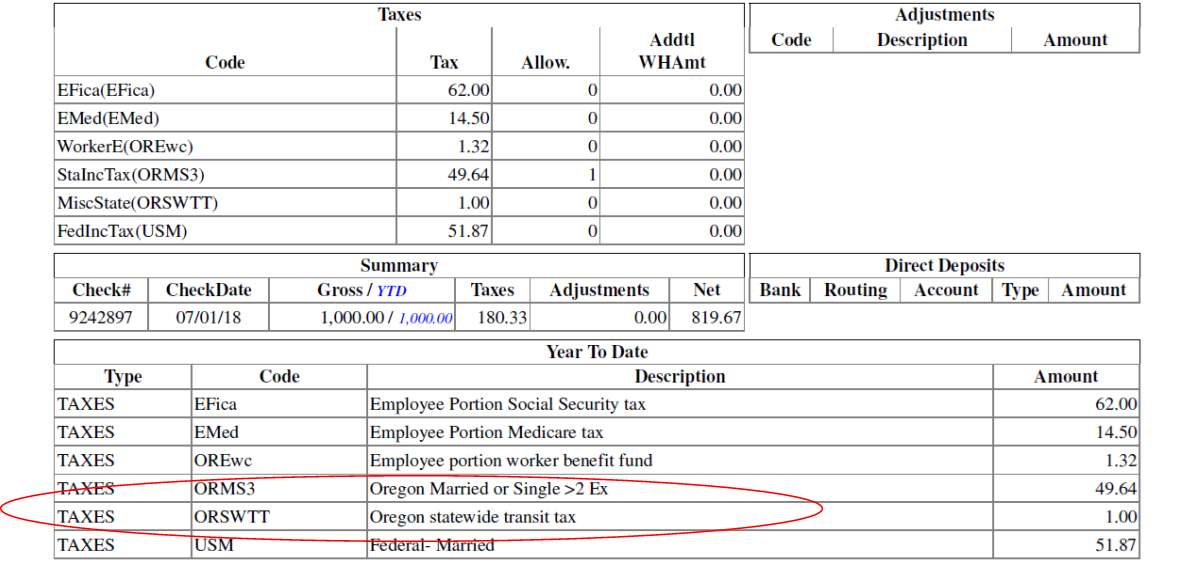

The current rate should be printed in the TriMetLTD portion of the Oregon Quarterly Combined Tax Report Form OQ. A Employers must report statewide transit tax withheld in Box 14 of the W-2 with the designation ORSTT WH in addition to the requirements in subsection 2 a of this rule. Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax.

There are some organizations whose payroll is exempt from transit payroll tax eg. The statewide transit tax requires employers to with-hold the tax one-tenth of 1 percent or 001 from. What is the Statewide Transit Individual Tax.

Under Oregons new Statewide Transit Tax employers must start withholding the tax one-tenth of 1 percent or 01 from wages of Oregon residents. Not all non-profit organizations are exempt from these transit taxes. Lets run a Payroll.

Your employer will be automatically. Unless there is a regulation under Texas law if they have employees in Oregon they need to withhold Oregon tax. On the table use the List button and add ORTIF to the Tax table.

Non-profit organizations need to send us a copy of the IRS. For electronic paystubs consider adding the following language to eHub or TeamTime messaging. The tax rate is 010 percent.

From the Payroll Setup menu select Taxes Tax Groups. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. Pay 20000 or more in.

The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. On July 1 2018. Starting July 1 2018 youll see a new item on your paystub.

The Statewide Transit Individual STI tax helps fund public transportation services within Oregon. Select State as the Tax level.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Solved I Do Not See The Oregon Transit Tax Or Unemployment Taxes Being Remitted By Quickbooks Do I Have To Remit These Myself

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

Wfr Oregon State Fixes 2022 Resourcing Edge

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More